UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

(RULE 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ý

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

ý Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Under Rule 14a-12

|

| | | | |

| | NEW YORK MORTGAGE TRUST, INC. | |

| | (Name of Registrant as Specified in Its Charter) | |

| | | | | |

| | (Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

| |

Payment of Filing Fee (Check the appropriate box):

| |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

| |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing is calculated and state how it was determined): |

| |

| 4) | Proposed maximum aggregate value of transaction: |

| |

| ☐ | Fee paid previously with preliminary materials. |

| |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

275 Madison90 Park Avenue

New York, New York 10016

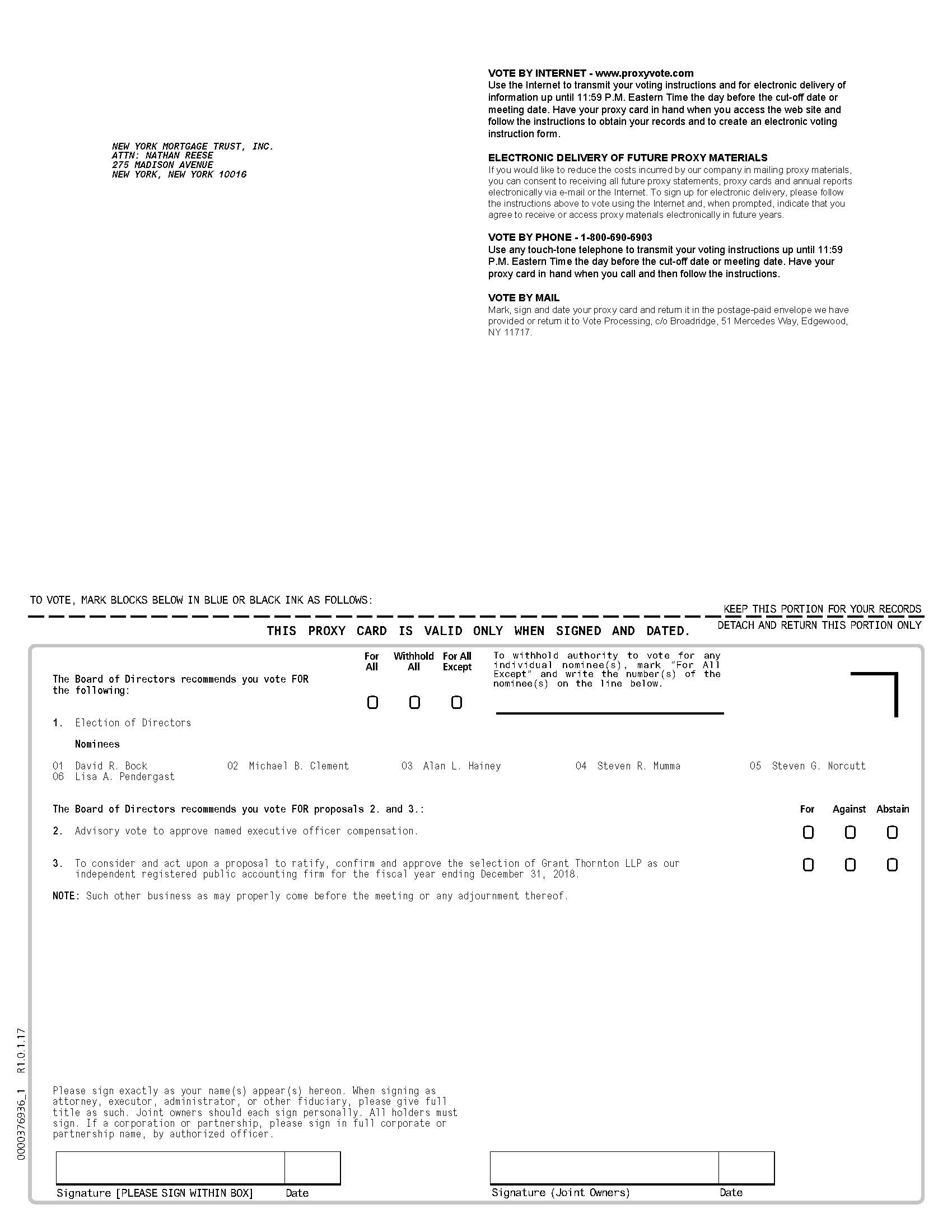

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 4, 201829, 2020

To Our Stockholders:

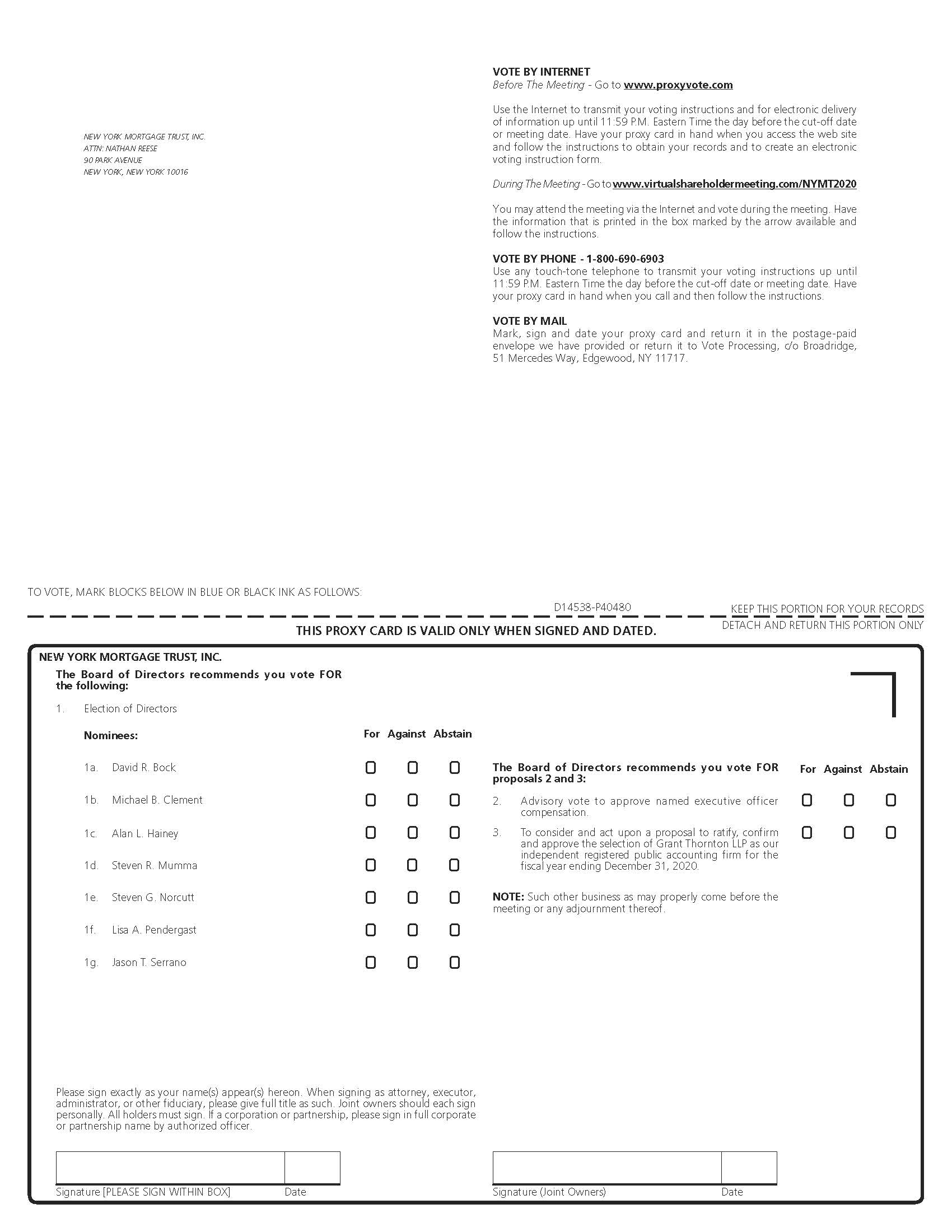

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of New York Mortgage Trust, Inc. (the “Company,” “we,” “our,” or “us”) on Monday, June 4, 201829, 2020 at 1:9:00 p.m.a.m., localEastern Time. Due to the emerging public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our stockholders, this year’s Annual Meeting will be held in a virtual meeting format only. We believe that the virtual meeting format allows enhanced participation of, and interaction with, our global stockholder base, while also being sensitive to the public health and travel concerns that our stockholders may have in light of the COVID-19 pandemic.

You will be able to attend the Annual Meeting virtually and vote and submit questions during the virtual Annual Meeting by visiting www.virtualshareholdermeeting.com/NYMT2020. During the live Q&A session of the virtual Annual Meeting, we may answer questions as they come in to the extent relevant to the business of the virtual Annual Meeting, as time atpermits.

At the offices of Vinson & Elkins L.L.P., 666 Fifth Avenue, 26th Floor, New York, New York 10103virtual Annual Meeting, you will be asked to consider and take action on the following:

1. To elect the sixseven directors nominated and recommended by the Board of Directors of the Company (the "Board of Directors"), each to serve until the 20192021 Annual Meeting of Stockholders or until such time as their respective successors are elected and qualified;

2. To hold an advisory vote to approve named executive officer compensation; and

3. To consider and act upon a proposal to ratify, confirm, and approve the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018.2020.

In addition, stockholders will consider and vote upon such other business as may properly come before the virtual Annual Meeting or any adjournment or postponement thereof.

The Board of Directors has set the close of business on April 9, 201824, 2020 as the record date for determining the stockholders entitled to notice of and to vote at the virtual Annual Meeting. Only stockholders of record on that date are entitled to notice of and to vote at the virtual Annual Meeting and at any adjournment or postponement thereof.

We furnish our proxy materials to our stockholders over the Internet, as we believe that this “e-proxy” process expedites stockholder receipt of proxy materials while also lowering the cost and reducing the environmental impact of our Annual Meeting. In connection with this approach, on or about April 20, 2018,29, 2020, we mailed a Notice Regarding the Availability of Proxy Materials (the “Notice”) to holders of our common stock as of the close of business on April 9, 2018.24, 2020. Beginning on the date of the mailing of the Notice, all stockholders of record had the ability to access all of the proxy materials and the Company’s Annual Report on Form 10-K on a website referred to in the Notice and to complete and submit their proxy on the Internet, over the telephone or through the mail. These proxy materials are available free of charge. If you received a Notice by mail, you will not receive a printed copy of the proxy materials. Instead, the Notice provides instructions on how you can request a paper copy of the proxy materials if you desire and each of the Notice and proxy materials provide instructions on how you can vote your proxy. Please see the attached proxy statement or Notice for more details on how you can vote.

If you wish to attend the Annual Meeting in person, you must register not later than 3:00 p.m., local time, on June 1, 2018 by contactingInvestor Relationsby emailat investorrelations@nymtrust.com or by phone at (646) 216-2360. Attendance at the Annual Meeting will be limited to persons that register in advance and present proof of stock ownership on the record date and picture identification. If you hold shares directly in your name as the stockholder of record, proof of ownership could include a copy of your account statement or a copy of your stock certificate(s). If you hold shares through an intermediary, such as a broker, bank or other nominee, proof of stock ownership could include a proxy from your broker, bank or other nominee or a copy of your brokerage or bank account statement. Additionally, if you intend to vote your shares at the Annual Meeting and hold your shares through an intermediary, you must request a “legal proxy” from your broker, bank or other nominee and bring this legal proxy to the Annual Meeting.

The Board of Directors appreciates and encourages your participation in the virtual Annual Meeting. Whether or not you plan to attend the virtual Annual Meeting, it is important that your shares be represented. Accordingly, please vote your shares by proxy, on the Internet, by telephone or by mail. If you attend the virtual Annual Meeting, you may revoke your proxy and vote in person.online at the virtual Annual Meeting. Your proxy is revocable in accordance with the procedures set forth in this proxy statement.

|

| | |

| | By order of the Board of Directors, |

| | |

| |

| |

| | Steven R. Mumma |

| | Chairman and Chief Executive Officer |

| New York, New York | | |

April 20, 201829, 2020 | | |

TABLE OF CONTENTS

|

| |

| | Page |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| |

INFORMATION ON OUR BOARD OF DIRECTORS AND ITS COMMITTEES | |

| | |

CERTAIN RELATIONSHIPS | |

| | |

COMPENSATION OF DIRECTORS | |

| |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | |

| |

EXECUTIVE OFFICERS | |

| | |

| |

| |

| |

| |

| |

| | |

| |

| | |

| |

| | |

AUDIT | |

| | |

RELATIONSHIP WITH INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| | |

OTHER MATTERS | |

| | |

ANNUAL REPORT | |

| | |

| |

| |

| |

This proxy statement contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. The Company’s actual results may differ from the Company’s beliefs, expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “believe,” “intend,” “seek,” “plan” and similar expressions or their negative forms, or by references to strategy, plans, or intentions. Forward-looking statements are based on the Company’s beliefs, assumptions and expectations of the Company’s future performance, taking into account all information currently available to it. For a discussion of these risks and uncertainties, see “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 and as updated by those risk factors included in the Company's subsequent filings under the Securities Exchange Act of 1934, as amended, which can be accessed at the SEC’s website at www.sec.gov. All forward-looking statements speak only as of the date on which they are made. New risks and uncertainties arise over time, and it is not possible to predict those events or how they may affect the Company. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

Proposal Roadmap

The following proposals will be voted on at the virtual Annual Meeting of the Stockholders:

|

| | |

| Proposal | Board Recommendation | For More Information |

Proposal No. 1: Election of Directors To elect the seven directors nominated and recommended by the Board of Directors of the Company, each to serve until the 2021 Annual Meeting of Stockholders or until such time as their respective successors are elected and qualified | For each director | |

Proposal No. 2: Advisory Vote to Approve Named Executive Officer Compensation To hold an advisory vote to approve named executive officer compensation | For | |

Proposal No. 3: Ratification, Confirmation and Approval of Appointment of Independent Registered Public Accounting Firm To consider and act upon a proposal to ratify, confirm, and approve the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020 | For | |

|

| |

2019 Company Highlights (1) |

We delivered annual total economic return of 16.5% that ranked fourth out of a mortgage REIT peer group comprised of 20 companies.(2) |

| We produced return on common stockholders' equity of 11.4% and total stockholders' return of 19.4%. |

| We expanded our investment portfolio by 57% and our capital base by 87%, acquiring $2.4 billion of predominantly credit assets. In addition, we expanded our total stockholders’ equity from approximately $1.2 billion to $2.2 billion. |

| We earned net income attributable to common stockholders in 2019 of $144.8 million, or $0.65 per share (basic), and comprehensive income to common stockholders of $192.1 million, or $0.87 per share. |

| We earned net interest income of $127.9 million and portfolio net interest margin of 248 basis points. |

| We paid aggregate dividends of $0.80 per common share. |

| We completed the internalization of our last externally-managed business, residential distressed credit. |

_________________________

| |

(1) | Unless otherwise stated, the measures used herein refer to our results as of and for the year ended December 31, 2019; all comparative metrics refer to the year ended December 31, 2019 as compared to the year ended December 31, 2018. |

| |

(2) | We define total economic return as the change in book value per common share plus common share dividends declared during the period. Please see the definition of “identified performance peer group” set forth on page 36 of this proxy statement for a list of the 20 peer mortgage REITs used for purposes of this peer group calculation. |

Executive Compensation Highlights

The Compensation Committee of our Board of Directors is committed to reviewing our executive compensation program on a regular basis and making changes based on the current market compensation practices, governance trends, and the results of our advisory vote to approve our named executive officer ("NEO") compensation, amongst other factors. The following highlights certain key features of our 2019 executive compensation program:

|

| |

| Key Features | Highlights |

| Base salary represents a minority of total compensation for named executive officers in 2019 | Base salary represented 19% of total compensation for our NEOs in 2019, including 2019 Long-Term EIP awards that cannot generally be earned and paid until December 31, 2021, and just 18% of our Chief Executive Officer's total compensation. |

| Majority of total compensation for named executive officers in 2019 was subject to a performance-based incentive plan | Approximately 70% of the total compensation for our NEOs in 2019, including 2019 Long-Term EIP awards that cannot generally be earned and paid until December 31, 2021, was subject to a performance-based incentive plan, while 79% of our Chief Executive Officer's total compensation in 2019 was subject to a performance-based incentive plan. |

| Updated forms of equity incentive award agreements to eliminate the “single trigger” for acceleration of vesting in change of control | In December 2019, we updated our forms of restricted stock award agreement and performance stock unit award agreement for 2020 awards such that awards granted to our employees under these forms will no longer accelerate or vest solely due to the occurrence of a change of control. |

Corporate Governance Highlights

Our Board of Directors is committed to maintaining best-in-class corporate governance practices and policies that are in the best interests of our stockholders. Highlights of our corporate governance practices are provided below.

|

|

| Corporate Governance Highlights |

• Independent Audit, Compensation, Investment and Nominating & Corporate Governance Committees. • Independent Lead Director. • Independent directors met in executive sessions of our Board of Directors on four separate occasions. • Annual election of all directors. • Majority voting standard in uncontested director elections. • 43% of our Board of Directors are diverse based on gender, race or ethnicity. • Average director tenure equals 8.6 years. • All three members of our Audit Committee qualify as “audit committee financial experts.” • Five of our seven directors are independent. • Stockholders, in addition to the Board of Directors, now have the power to alter, amend or repeal our Bylaws and to make new Bylaw provisions, in each case by the affirmative vote of the holders of a majority of the shares of our common stock then outstanding and entitled to vote on the proposed amendment. • No shareholder rights plan or “poison pill.” • No “related person transactions” in 2019. • Directors and executive officers are subject to robust stock ownership guidelines. • Directors and executive officers are prohibited from engaging in short-selling, pledging or hedging transactions involving our securities. • Our Chief Executive Officer's equity awards will not accelerate or vest solely due to a change in control; beginning with our 2020 equity awards, our other named executive officers' equity awards will not accelerate or vest solely due to a change in control. |

275 Madison90 Park Avenue

New York, New York 10016

PROXY STATEMENT

GENERAL INFORMATION

Important Notice Regarding the Availability of Proxy Materials

for the 20182020 Stockholder Meeting to Be Held on June 4, 2018.29, 2020.

This proxy statement, our Annual Report on Form 10-K for the year ended December 31, 2017,2019, and

our other proxy materials are available at: http://www.proxyvote.com.

Proxy Solicitation

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors ("Board of Directors") of New York Mortgage Trust, Inc. (the “Company,” “we,” “our” or “us”) for use at the Company’s Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the offices of Vinson & Elkins L.L.P., 666 Fifth Avenue, 26th Floor, New York, New York 10103 on Monday, June 4, 201829, 2020 at 1:9:00 p.m.a.m., local time,Eastern Time, and at any adjournment and postponement thereof. Due to the emerging public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our stockholders, this year’s Annual Meeting will be held in a virtual meeting format only. We believe that the virtual meeting format allows enhanced participation of, and interaction with, our global stockholder base, while also being sensitive to the public health and travel concerns that our stockholders may have in light of the COVID-19 pandemic.

You will be able to attend the Annual Meeting virtually and vote and submit questions during the virtual Annual Meeting by visiting www.virtualshareholdermeeting.com/NYMT2020. You will need the 16-digit control number included in your proxy card to vote and submit questions during the virtual Annual Meeting. During the live Q&A session of the virtual Annual Meeting, we may answer questions as they come in to the extent relevant to the business of the virtual Annual Meeting, as time permits.

We mailed, through intermediaries, on or about April 20, 2018,29, 2020, a Notice Regarding the Availability of Proxy Materials (the “Notice”) to our stockholders of record as of April 9, 2018.24, 2020. As a result, beginning on the date of the mailing of the Notice, all stockholders of record had the ability to access all of the proxy materials and the Company’s Annual Report on Form 10-K for the year ended December 31, 20172019 (“20172019 Annual Report”) on a website referred to in the Notice and as set forth above. If you received a Notice by mail, you will not receive a printed copy of the proxy materials in the mail. Instead, the Notice instructs you on how to access and review all of the important information contained in the proxy statement and 20172019 Annual Report. The Notice also instructs you on how you may submit your proxy over the Internet. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the Notice.

The mailing address of our principal executive offices is 275 Madison90 Park Avenue, New York, New York 10016. We maintain an Internet website at www.nymtrust.com. Information at or connected to our website is not and should not be considered part of this proxy statement.

We will bear the costs of this solicitation including the costs of preparing, assembling and mailing proxy materials and the handling and tabulation of proxies received. In addition to solicitation through the Internet or by mail, proxies may be solicited by our directors, officers and employees, at no additional compensation, by telephone, personal interviews or otherwise. Banks, brokers or other nominees and fiduciaries will be requested to forward the Notice and information on how to access the proxy materials to beneficial owners of our common stock and to obtain authorization for the execution of proxies. We will, upon request, reimburse such parties for their reasonable expenses in forwarding proxy materials to beneficial owners.

No person is authorized to give any information or to make any representation not contained in this proxy statement and, if given or made, you should not rely on that information or representation as having been authorized by us. The delivery of this proxy statement shall not, under any circumstances, imply that there has been no change in the information set forth since the date of this proxy statement.

Purposes of the Virtual Annual Meeting

The principal purposes of the virtual Annual Meeting are to: (1) elect the sixseven directors nominated and recommended by our Board of Directors, each to serve until the 20192021 Annual Meeting of Stockholders or until such time as their respective successors are elected and qualified (“Proposal No. 1”); (2) hold an advisory vote to approve named executive officer compensation (“Proposal No. 2”); (3) consider and act upon a proposal to ratify, confirm, and approve the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 20182020 (“Proposal No. 3”); and (4) transact such other business as may properly come before the virtual Annual Meeting or any adjournment or postponement thereof. Our Board of Directors knows of no other matters other than those stated above to be brought before the virtual Annual Meeting.

VOTING

How to Vote Your Shares

You may vote your shares atduring the virtual Annual Meeting until such time as the chairman declares the polls closed by visiting www.virtualshareholdermeeting.com/NYMT2020 and following the instructions. You will need the 16-digit control number included in person. If you cannot attend the Annual Meeting in person,your proxy card, voting instruction form or you wish to have your shares voted by proxy evenNotice and Access Card. Even if you do attend the virtual Annual Meeting, you may vote by duly authorized proxy on the Internet, by telephone or by mail. We encourage you to follow the instructions on how to vote as described below and as set forth in the Notice and the proxy card. Maryland law provides that a vote by Internet or telephone carries the same validity as your completion and delivery of a proxy card. In order to vote on the Internet, you must first go to http://www.proxyvote.com, have your Notice or proxy card in hand and follow the instructions.

In order to vote by telephone, you must call (800) 690-6903, have your Notice or proxy card in hand and follow the instructions.

Stockholders of record may vote by signing, dating and returning a proxy card in a postage-paid envelope. You may request a proxy card postage-paid envelope from us as instructed in the Notice. Properly signed and returned proxies will be voted in accordance with the instructions contained therein.

Even if you plan to attend the live webcast of the Annual Meeting, we encourage you to vote in advance by Internet, telephone or mail so that your vote will be counted even if you later decide not to attend the virtual Annual Meeting. We will provide a physical location to view the webcast if requested by a stockholder in writing by contacting the Secretary at New York Mortgage Trust, Inc., 90 Park Avenue, 23rd Floor, New York, New York 10016 or by phone at (646) 216-2366. Please note that no members of management or our Board of Directors will be in attendance at the physical location.

Registered Holders, Beneficial Owners and “Broker Non-Votes”

Registered Holders. If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, you are considered the registered stockholder of record with respect to those shares, and a Notice is being sent directly to you. As the registered stockholder of record, you have the right to grant your voting proxy directly to the Company through a proxy card, through the Internet or by telephone or to vote in person at the virtual Annual Meeting.

If you are a registered stockholder of record and you indicate when voting on the Internet or by telephone that you wish to vote as recommended by our Board of Directors, or you sign and return a proxy card without giving specific voting instructions, the proxy holders will vote your shares in the manner recommended by our Board of Directors on all matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the virtual Annual Meeting.

Beneficial Owners and “Broker Non-Votes.” A large number of our stockholders hold their shares through a broker, trustee, bank or other nominee rather than directly in their own name. If your shares are held in a stock brokerage account or by a bank, trustee or other nominee, you are considered the beneficial owner of the shares, while the broker, trustee, bank or nominee holding your shares is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, trustee, bank or other nominee on how to vote and are also invited to attend the virtual Annual Meeting. If your shares are held in this manner, your broker, trustee, bank or other nominee will provide you with instructions for you to use in accessing the proxy materials and directing the broker, trustee, bank or other nominee on how to vote your shares. If your shares are not directly registered in your own name and you plan to vote your shares in person atduring the virtual Annual Meeting, you must contact the bank, broker, trustee or other nominee that holds your shares to obtain a legal proxy or broker’s proxy card and bring it toin advance of the virtual Annual Meeting in order to vote.

If you are the beneficial owner of shares that are held in a stock brokerage account or by a bank or other nominee and you do not provide the organization that holds your shares with specific voting instructions, by rule, the organization that holds your shares may generally vote at its discretion on routine matters only. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization will inform Broadridge Financial Solutions, Inc., which is receiving and tabulating the proxies, that it does not have the authority to vote your shares on non-routine matters. This is generally referred to as a “broker non-vote.” Because the proposal to ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm is a routine matter for which specific instructions from beneficial owners are not required, no broker non-votes will arise in the context of voting for the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018.2020. Conversely, the election of directors is a non-routine matter for which specific instructions from beneficial owners are required and thus, broker non-votes may arise. Additionally, the Securities and Exchange Commission (“SEC”) has specifically prohibited broker discretionary voting of uninstructed shares with respect to the advisory vote to approve named executive officer compensation. As a result, if you hold your shares through a broker, bank or other nominee, your broker, bank or other nominee cannot vote your shares on the election of directors, or the advisory votevotes to approve named executive officer compensation in the absence of your specific instructions as to how to vote on these matters. In order for your vote to be counted on these matters, please make sure that you provide specific voting instructions to your broker, bank or other nominee.

How to Revoke Your Proxy

If you have already voted your proxy on the Internet or by telephone or returned your proxy to us by mail, you may revoke your proxy at any time before it is exercised at the virtual Annual Meeting by any of the following actions:

by notifying our Investor Relations in writing that you would like to revoke your proxy;

by completing, at or before the virtual Annual Meeting, a proxy card on the Internet, by telephone or by mail with a later date; or

by attending the virtual Annual Meeting and voting in person.at www.virtualshareholdermeeting.com/NYMT2020. (Note, however, that your attendance at the virtual Annual Meeting, by itself, will not revoke a proxy you have already returned to us; you must also vote your shares in persononline at the virtual Annual Meeting to revoke an earlier proxy.)

If your shares of common stock are held on your behalf by a broker, bank or other nominee, you must contact them to receive instructions as to how you may revoke your proxy instructions.

Record Date for Our Annual Meeting; Who Can Vote at Our Annual Meeting; Voting Procedures and Vote Required

Our Board of Directors has fixed the close of business on April 9, 201824, 2020 as the record date for the determination of stockholders entitled to receive notice of and to vote at the virtual Annual Meeting and all adjournments or postponements thereof. On all matters to come before the virtual Annual Meeting, each holder of record of our common stock as of the close of business on April 9, 201824, 2020 will be entitled to vote at the virtual Annual Meeting and will be entitled to one vote for each share of common stock owned as of such date. As of the close of business on April 9, 2018,24, 2020, the Company had 112,111,386377,465,405 shares of common stock outstanding.

The representation in person online or by proxy of a majority of all the votes entitled to be cast on the matters to be considered at the meeting is necessary to provide a quorum for the transaction of business at the virtual Annual Meeting. Your shares will be counted as present at the virtual Annual Meeting if you attend online and are present and entitled to vote at the virtual Annual Meeting, or you have properly submitted a proxy card or voting instruction card, or voted by telephone or over the Internet. Both abstentions and broker non-votes are counted for purposes of determining the presence of a quorum. If a quorum is not present, the chairman may adjourn the virtual Annual Meeting may be adjourned byto a date not more than 120 days after the vote of a majority ofrecord date without notice other than announcement at the shares represented at thevirtual Annual Meeting until a quorum has been obtained.

With respect to the election of directors, the votebecause this is considered an uncontested election under our bylaws, a nominee for director is elected to our Board of Directors if he or she receives a pluralitymajority of all the votes cast atfor his or her election, meaning the Annual Meeting at which a quorum is present is necessarynumber of shares voted for such nominee’s election exceeds the number of shares voted against such nominee’s election. Abstentions and broker non-votes will not affect the election of directors. In tabulating the voting results for the election of directors, only “for” and “against” votes are counted. If an incumbent director receives a director.greater number of votes against his or her election than votes for such election, such director shall tender his or her resignation as provided in our Director Resignation Policy. The six nominees who receiveNominating & Corporate Governance Committee of our Board of Directors will then act as soon as reasonably practicable thereafter to determine whether to accept the most votesdirector’s tendered resignation and will be elected.submit such recommendation for consideration by our Board of Directors. In considering whether to accept or reject the tendered resignation, the Nominating & Corporate Governance Committee and the Board will consider any factors they deem relevant or appropriate. There is no cumulative voting in the election of directors. Abstentions and broker non-votes will not be counted as votes cast and, because the vote of a plurality is required, will have no effect on the result of the vote for election of directors.

With respect to the advisory vote to approve named executive officer compensation, the affirmative vote of a majority of the votes cast on this proposal at the virtual Annual Meeting is necessary for approval, on an advisory basis, of our named executive officer compensation. Abstentions and broker non-votes will not count as votes cast on the advisory vote to approve named executive officer compensation,this proposal, and thus will have no effect on the result of the vote on this proposal.

With respect to the proposal to ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm, the affirmative vote of a majority of the votes cast on this matter at the virtual Annual Meeting is necessary for ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018.2020. Abstentions will not count as votes cast on this proposal and thus will have no effect on the result of the vote. As noted above, no broker non-votes will arise in the context of the proposal to ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018.2020.

Pursuant to our charter, holders of shares of our common stock are not entitled to exercise appraisal rights under the Maryland General Corporation Law unless our Board of Directors, upon the affirmative vote of a majority of our Board of Directors, shall determine that such rights apply to one or more transactions occurring after the date of such determination. Our Board of Directors has made no such determination with respect to the business to be considered at the virtual Annual Meeting.

PROPOSAL NO. 1: ELECTION OF DIRECTORS

The sixseven persons named below have been nominated to serve on our Board of Directors until the 20192021 Annual Meeting of Stockholders or until such time as their respective successors are elected and qualified. Our Board of Directors is currently comprised of sixseven directors, five of whom are independent in accordance with our Corporate Governance Guidelines and the listing standards of the Nasdaq Stock Market (“Nasdaq”). Each nominee is currently a director of the Company and has consented to stand for election at the virtual Annual Meeting. The Board of Directors has no reason to believe that the persons named below as nominees for directors will be unable, or will decline to serve, if elected. For additional information regarding our corporate governance and these nominees, see “Information on Our Board of Directors and Its Committees” below.

Board of Directors Considerations in Recommending These Nominees

Our Board of Directors believes that the Board of Directors, as a whole, should encompass a range of talent, skill, diversity and expertise enabling it to provide sound guidance with respect to our operations and interests. In identifying qualified director nominees, the Nominating & Corporate Governance Committee of our Board of Directors, and our Board of Directors consider, among other things, a candidate’s experience, skills, accomplishments, background, age, diversity, willingness to serve and commitment to the Company, and then review those qualities in the context of the current composition of our Board of Directors and the evolving needs of our business. Because we are listed on the Nasdaq Global Select Market, we are required to have at least a majority of our directors qualify as “independent,” as such term is defined by the Nasdaq. The Nominating & Corporate Governance Committee identifies candidates for election to our Board of Directors with input from our other directors, reviews the qualities listed above and recommends to our Board of Directors individual nominees for director.

Our Board of Directors seeks director nominees with strong reputations, experience, competence or expertise in areas relevant to the strategy and operations of our business, particularly in the finance or mortgage industries, or the proper and effective functioning of our Board of Directors. Each of the nominees for election as a director at the virtual Annual Meeting holds or has held important positions and has operating experience or other relevant experience that meets this objective. In these positions, they have also gained experience in some or all of the following: core management skills, such as strategic and financial planning, public company financial reporting, accounting, corporate governance, risk management and leadership development.

Our Board of Directors also believes that each of the nominees listed below has other key attributes that are important to a properly functioning and effective board, including integrity and high ethical standards, sound judgment, analytical skills, the ability and desire to engage management and each other in a constructive fashion, and the commitment to devote significant time and energy to service on our Board of Directors and its committees.

Nominees for Election as Directors

The following table sets forth the names and biographical information concerning each of the directors nominated for election at the virtual Annual Meeting:

| | | Name | | Principal Occupation | | Director Since | | Age | | Principal Occupation | | Director Since | | Age |

| Steven R. Mumma† | | Chairman and Chief Executive Officer | | 2007 | | 59 | | Chairman and Chief Executive Officer of the Company | | 2007 | | 61 |

| Jason T. Serrano | | | President of the Company | | 2019 | | 45 |

| David R. Bock* | | Managing Partner of Federal City Capital Advisors | | 2012 | | 74 | | Retired Managing Partner of Federal City Capital Advisors | | 2012 | | 76 |

| Michael B. Clement* | | Professor of Accounting at University of Texas at Austin | | 2016 | | 61 | | Chairman of the Department of Accounting at the University of Texas at Austin | | 2016 | | 63 |

| Alan L. Hainey* | | Owner and Manager of Carolina Dominion, LLC | | 2004 | | 71 | | Owner and Manager of Carolina Dominion, LLC | | 2004 | | 74 |

| Steven G. Norcutt* | | President of Schafer Richardson, Inc. | | 2004 | | 58 | | President of Schafer Richardson, Inc. | | 2004 | | 60 |

| Lisa A. Pendergast* | | Executive Director of Commercial Real Estate Finance Council | | 2018 | | 56 | | Executive Director of Commercial Real Estate Finance Council | | 2018 | | 58 |

|

| |

| * | Our Board of Directors has affirmatively determined that these director nominees currently are independent under the criteria described below in “Information on Our Board of Directors and Its Committees—Independence of Our Board of Directors” and “Information on Our Board of Directors and Its Committees—Board of Directors Leadership Structure.” Mr. Hainey is our Lead Director. |

|

| |

| † | Chairman of our Board of Directors. |

Steven R. Mumma is our Chairman and Chief Executive Officer. Mr. Mumma has served as Chairman of our Board of Directors effective since March 30, 2015. Mr. Mumma has served as Chief Executive Officer since February 3, 2009. Mr. Mumma was appointed President, a role he held until May 2016, and Co-Chief Executive Officer effective March 31, 2007 which marked the divestment of the Company’s mortgage lending business, and served as Chief Financial Officer from November 2006 to October 2010. Prior to serving in the above capacities, Mr. Mumma served as our Chief Investment Officer, a position to which he was named in July 2005, and as Chief Operating Officer, commencing in November 2003. From September 20001981 to September 2003, Mr. Mumma was a Vice President of Natexis ABM Corp., a wholly-owned subsidiary of Natexis Banques Populaires. From 1997 to 2000, Mr. Mumma served as a Vice President of Mortgage-Backed Securities tradingin various financial and accounting roles for Credit Agricole. Prior to joining Credit Agricole, from 1988 to 1997, Mr. Mumma was a Vice President of Natexis ABM Corp. Prior to joining Natexis ABM Corp., from 1986 to 1988, Mr. Mumma was a Controller for PaineWebber Real Estate Securities Inc., the mortgage-backed trading subsidiary of PaineWebber Inc. Prior to joining PaineWebber, from 1981 to 1985, Mr. Mumma worked for Citibank in its Capital Markets Group, as well as for Ernst & Young LLP.financial and accounting institutions. Mr. Mumma received a B.B.A. cum laude from Texas A&M University.

Our Board of Directors concluded that Mr. Mumma should serve as a director of the Company because of his significant operational, financial and accounting experience in, and knowledge of, the Company, which he has served since shortly after our inception in 2003, and the broader mortgage-backed securities industry, where he has worked for more than 20 years. As Chairman and Chief Executive Officer of the Company, Mr. Mumma also serves as a critical link between management and our Board of Directors.

Jason T. Serrano is our President. Mr. Serrano was named President of the Company effective January 7, 2019 and became a member of our Board of Directors on March 19, 2019. Prior to joining the Company, Mr. Serrano was a Partner at Oak Hill Advisors, L.P. (“OHA”), an alternative investment management firm, from January 2014 to December 2018 and a Managing Director at OHA from April 2008 to December 2013. While at OHA, Mr. Serrano ran the mortgage investment business. Prior to joining OHA, Mr. Serrano served as a Principal at The Blackstone Group, where he led the structured finance investment team. Before Blackstone, he spent five years at Fortress Investment Group as Vice President, assisting in the management of $2 billion of distressed structured products and whole-loan portfolios. He also spent five years at Moody’s as a rating analyst for collateralized debt obligations and derivatives. He earned a bachelor of science degree from Oswego State University.

Our Board of Directors concluded that Mr. Serrano should serve as a director of the Company because of his experience with, and strategic insights into, managing, sourcing and creating multiple forms of single-family and multi-family credit assets, credit and market risks and financing matters and capital raising. Mr. Serrano also serves as a critical link between management and our Board of Directors and solidifies our senior management bench strength.

David R. Bock has served as a member of our Board of Directors since January 2012. Mr. Bock iswas a Managing Partner of Federal City Capital Advisors, a Washington, DC-based business and financial advisory services company and has held this position since 2004.from 2004 to 2019. Mr. Bock has a background in international economics and finance, capital markets and organizational development, having served as a Managing Director of Lehman Brothers and in various executive roles at the World Bank, including as the chief of staff for the World Bank’s lending operations. Mr. Bock was the Chief Financial Officer of I-Trax, Inc., a publicly traded healthcare company prior to its sale to Walgreen’s in 2008, and previously the Chief Financial Officer of Pedestal Inc., an online mortgage trading platform. Mr. Bock served as interim Chief Executive Officer of Oxford Analytica in 2010. Mr. Bock began his professional career with McKinsey & Co. following completion of an advanced degree in economics from Oxford University, where he was a Rhodes Scholar. He received a B.A. in philosophy from the University of Washington. Mr. Bock currently servespreviously served on the Boardsboards of the Amundi Pioneer Funds complex, where he servesserved as chairman of the audit committee, as well asand currently serves on the boards of various private and charitable organizations. Mr. Bock previously served on our Board of Directors from 2004 to 2009.

Our Board of Directors concluded that Mr. Bock should serve as a director of the Company because of his extensive expertise in economics, finance and accounting and his prior experiences in our industry, as well as his prior experiences as a Chief Financial Officer, Chief Executive Officer and director of other companies.

Michael B. Clement has served as a member of our Board of Directors since June 2016. Mr. Clement has been a professor inis the Chairman of the Department of Accounting at the University of Texas at Austin where, since 2011 and1997, he has held the positions of professor, associate professor, and assistant professor positions in the Department of Accounting at the University of Texas at Austin since 1997.professor. Mr. Clement was the Vice President of Global Investment Research for Goldman Sachs & Co. from 2002 until 2004. Mr. Clement was the Vice President of Capital Planning and Analysis from 1988 to 1991 and a Manager of the Audit Division from 1982 to 1986 at Citicorp. Prior to his employment at Citicorp, Mr. Clement was a Senior Assistant Accountant at Deloitte Haskins & Sells. Mr. Clement holds a B.B.A. in Accounting from Baruch College, an M.B.A. in Finance from the University of Chicago and a Ph.D. in Accounting from Stanford University. Mr. Clement currently serves on the board and audit committee of multiple funds that comprise the AXA Equitable funds complex.

Our Board of Directors concluded that Mr. Clement should serve as a director of the Company because of his significant expertise in accounting and his prior experience working in the finance industry.

Alan L. Hainey has served as a member of our Board of Directors since the completion of our initial public offering (“IPO”) in June 2004 and became our Lead Director in March 2015. Mr. Hainey is the owner and manager of Carolina Dominion, LLC, a real estate brokerage development and investment firm that he founded in 2004. In 2001, Mr. Hainey incorporated and funded the Merrill L. Hainey Family Foundation, a not-for-profit charitable organization dedicated to academic achievement through scholarships, where he continues to serve as President. From 1996 to 2000, Mr. Hainey operated an independent consulting practice providing advisory and marketing services to clients engaged in insurance, mortgage finance and investment management. From 1990 to 1996, Mr. Hainey served as President and Chief Operating Officer of GE Capital’s mortgage banking businesses and was a member of GE Capital's corporate executive council. From 1983 to 1990, Mr. Hainey served as President of GE Capital Mortgage Securities. Mr. Hainey received a B.A. with honors and a J.D. from the University of Missouri and a Master of Management with distinction from the Kellogg School of Northwestern University.

Our Board of Directors concluded that Mr. Hainey should serve as a director of the Company because of his valuable business, leadership and management skills obtained during his 30-plus years in the mortgage banking business, including as President of GE Capital’s mortgage banking business and as a member of its executive council.

Steven G. Norcutt has served as a member of our Board of Directors since completion of our IPO in June 2004. Mr. Norcutt has served since October 2009 as the President of Schafer Richardson, Inc., a commercial real estate management, construction, development, leasing and investment company based in Minneapolis, Minnesota. From April 2008 to October 2009, Mr. Norcutt served as Senior Vice President – Regional Manager of Guaranteed Rate Mortgage, a residential mortgage banking company headquartered in Chicago, Illinois. Prior to joining Guaranteed Rate, Mr. Norcutt served as Executive Vice President and Chief Operating Officer of Centennial Mortgage and Funding, Inc., a residential mortgage banking company based in Minnesota. Prior to joining Centennial Mortgage and Funding, Inc., Mr. Norcutt served as Senior Vice President and Portfolio Manager of Structured Finance for Reliastar Investment Research, Inc. from 1993 through 2001. Mr. Norcutt joined Reliastar Investment Research, Inc. in 1988 as Vice President and Portfolio Manager of Residential Mortgage Loans. Mr. Norcutt received an M.B.A. in Finance from the Carlson School of Business at the University of Minnesota and a B.S. in Finance from St. Cloud State University.

Our Board of Directors concluded that Mr. Norcutt should serve as a director of the Company because of his extensive operating, business and financial experience from significant tenures in both the mortgage lending and mortgage portfolio management businesses, as well as his current role as President of a commercial real estate company.

Lisa A. Pendergast joinedhas served as a member of our Board of Directors insince March 2018. Ms. Pendergast is currently Executive Director of Commercial Real Estate Finance Council, a trade organization with over 305 member companies and over 9,000 individual members that covers the commercial and multi-family real estate finance markets, a position she has held since September 2016. Ms. Pendergast was Managing Director of the Commercial Mortgage-Backed Securities Strategy and Risk division of Jefferies LLC from 2009 to June 2016. From 2001 to 2009, Ms. Pendergast was Managing Director of the Commercial Mortgage-Backed Securities Strategy division of RBS Greenwich Capital. Prior to her employment at RBS Greenwich Capital, Ms. Pendergast was Managing Director in the Financial Strategies Group at Prudential Securities from 1987 to 2000. Ms. Pendergast holds a B.A. in English Literature and Political Science from Marymount College of Fordham University.

Our Board of Directors concluded that Ms. Pendergast should serve as a director of the Company because of her extensive relevant experience in the commercial and residential real estate markets, as well as her significant expertise in commercial credit and structured finance. Ms. Pendergast's name as a potential candidate for director was initially referred to the Nominating & Corporate Governance Committee by our Chief Executive Officer.

Our Board of Directors recommends that stockholders vote “FOR” the election of each of the nominees.

PROPOSAL NO. 2: ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION

Section 14A of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), added by the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) provides our stockholders with an advisory vote to approve our named executive officer compensation. This advisory vote gives our stockholders the opportunity to express their views on the compensation of our named executive officers. Although this vote is advisory and is not binding, the Board of Directors and the Compensation Committee plan to take into consideration the outcome of the vote when making future executive compensation decisions.

At our 20132019 Annual Meeting of Stockholders, a majority of stockholders voted in favor of having an advisory vote to approve our named executive officer compensation each year, consistent with the recommendation of our Board of Directors. After consideration of these results and our Board of Director’s recommendation, we elected to hold future advisory votes on named executive officer compensation each year until the next advisory vote on frequency occurs. We are required under the Dodd-Frank Act to hold an advisory vote on the frequency of the advisory votes to approve named executive officer compensation at least every six years.

As described in detail under “Executive Compensation—Compensation Discussion and Analysis,” our compensation program for 20172019 was designed to compensate our named executive officers in a manner that attracts and retains top performing employees, motivates our management team by tying compensation to our financial performance, and rewards exceptional individual performance that supports our overall objectives, while also consistent with our needs as a company to maintain an appropriate expense structure. Our Board of Directors believes that our current executive compensation program compensates our named executive officers in an appropriate manner in relation to the size and performance of the Company and properly aligns the interests of our named executive officers with those of our stockholders. We utilized the 2013 Incentive Compensation Plan as effective for fiscal year 2017 (the “20172019 Annual Incentive Plan”),Plan, a performance-based incentive compensation plan that serves as a means of linking compensation both to our overall performance and to objective and subjective performance criteria that are within the control of our named executive officers (the “2019 Annual Incentive Plan”), for determining incentive compensation payable to our named executive officers for performance in 2017.2019.

During 2019, we also utilized the 2019 Long-Term Equity Incentive Program in our overall executive compensation structure that promotes recruitment and retention of key employees and rewards employees for outperformance relative to our peers over the longer-term. Our 2019 Long-Term Equity Incentive Program provides for long-term equity awards that can be earned on December 31, 2021 based on the achievement of certain relative total stockholder return hurdles over a three-year performance period.

See the information set forth under “Executive Compensation—Compensation Discussion and Analysis” and “Executive Compensation—Executive Compensation Information” for more information on these elements of our named executive officer compensation program.

For these reasons, the Board of Directors strongly endorses our named executive officers compensation program and recommends that stockholders vote in favor of the following resolution:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed under the compensation disclosure rules of the SEC, including the “Executive Compensation—Compensation Discussion and Analysis,” compensation tables and narrative discussion contained in the proxy statement for the 20182020 Annual Meeting of Stockholders.”

Our Board of Directors recommends that stockholders vote “FOR” the approval, on an advisory basis, of our named executive officer compensation.

PROPOSAL NO. 3: RATIFICATION, CONFIRMATION AND APPROVAL OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of our Board of Directors is directly responsible for the appointment, evaluation, compensation, retention and oversight of the independent registered public accounting firm that audits our financial statements and our internal control over financial reporting. The Audit Committee has appointed Grant Thornton LLP, or Grant Thornton, as our independent registered public accounting firm for the fiscal year ending December 31, 2018.2020. Grant Thornton has served as our independent registered public accounting firm since December 2009.

The Audit Committee annually reviews Grant Thornton’s independence and performance in deciding whether to retain Grant Thornton or engage a different independent registered public accounting firm. In the course of these reviews, the Audit Committee considers, among other things:

Grant Thornton's historical and recent performance on our audit;

Grant Thornton's capability and expertise in handling the breadth and complexity of our business;

AppropriatenessThe appropriateness of Grant Thornton's fees for audit and non-audit services, on both an absolute basis and as compared to its peer firms; and

Grant Thornton's independence and tenure as our auditor.

Based on this evaluation, the Audit Committee believes that Grant Thornton is independent and that it is in the best interests of our Company and our stockholders to retain Grant Thornton as our independent registered public accounting firm for the fiscal year ending December 31, 2018.2020.

Although stockholder approval is not required, we desire to obtain from our stockholders an indication of their approval or disapproval of the Audit Committee’s action in appointing Grant Thornton as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2018.2020. Although we seek ratification of the appointment of Grant Thornton as our independent registered public accounting firm, the ratification of the appointment of Grant Thornton does not preclude the Audit Committee from subsequently determining to change independent registered public accounting firms if it determines such action to be in the best interests of the Company and its stockholders. If our stockholders do not ratify, confirm and approve this appointment, the appointment will be reconsidered by the Audit Committee and our Board of Directors.

We expect that a representative of Grant Thornton will be present atattend the virtual Annual Meeting where the representative will be afforded an opportunity to make a statement and to respond to appropriate questions.

Our Board of Directors recommends that you vote “FOR” the ratification, confirmation and approval of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018.2020.

INFORMATION ON OUR BOARD OF DIRECTORS AND ITS COMMITTEES

Corporate Governance Highlights

Our Board of Directors is committed to maintaining best-in-class corporate governance practices and policies that are in the best interests of our stockholders. Highlights of our corporate governance practices are provided below:

Five of our sixseven directors are independent.

Independent Audit, Compensation, Investment and Nominating & Corporate Governance Committees.

Independent Lead Director.

Independent directors met in executive sessions of our Board of Directors on fivefour separate occasions.

Annual election of all directors.

33%Majority voting standard in uncontested director elections.

43% of our Board of Directors are diverse based on gender, race or ethnicity.

Average director tenure equals 7.88.6 years.

ThreeAll three members of our four Audit Committee Members qualify as “audit committee financial experts.”

Stockholders, in addition to the Board of Directors, now have the power to alter, amend or repeal our Bylaws and to make new Bylaw provisions, in each case by the affirmative vote of the holders of a majority of the shares of our common stock then outstanding and entitled to vote on the proposed amendment.

No shareholder rights plan or “poison pill.”

No “related person transactions” in 2017.2019.

Our non-employee directorsDirectors and Chief Executive Officerexecutive officers are subject to robust stock ownership guidelines.

Directors and executive officers are prohibited from engaging in short-selling, pledging or hedging transactions involving our securities.

Our Chief Executive Officer's equity awards will not accelerate or vest solely due to a change in control;

beginning with our 2020 equity awards, our other named executive officers' equity awards will not accelerate or vest solely due to a change in control.

Independence of Our Board of Directors

Our Corporate Governance Guidelines and the listing standards of the Nasdaq require that a majority of our directors be independent. Our Board of Directors has adopted the categorical standards prescribed by the Nasdaq to assist our Board of Directors in evaluating the independence of each of our directors. The categorical standards describe various types of relationships that could potentially exist between a board member and the Company and sets thresholds at which such relationships would be deemed to be material. Provided that no relationship or transaction exists that would disqualify a director under the categorical standards and our Board of Directors affirmatively determines that the director has no material relationship with the Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, including certain business relationships for which disclosure may be required in this proxy statement, our Board of Directors will deem such person to be independent. A director shall not be independent if he or she satisfies any one or more of the following criteria:

A director who is, or who has been within the last three years, an employee of the Company, or whose immediate family member is, or has been within the last three years, employed as an executive officer of the Company;

A director who has accepted or who has an immediate family member, serving as an executive officer, who has accepted, during any twelve-month period within the last three years, more than $120,000 in direct compensation from the Company (excluding compensation for board or board committee service, compensation paid to an immediate family member who is an employee of the Company (but not an executive officer of the Company), and benefits under a tax-qualified retirement plan, or non-discretionary compensation);

A director who is, or whose immediate family member is, a current partner of a firm that is the Company’s internal or external auditor, or was a partner or employee of the Company’s outside auditor who worked on ourthe Company’s audit at any time during any of the past three years;

A director who is, or whose immediate family member is, employed as an executive officer of another entity where at any time during the past three years any of the executive officers of the Company served on the compensation committee of such other entity; or

A director who is, or whose immediate family member is, a partner in, or a controlling shareholder or an executive officer of, any organization to which the Company made, or from which the Company received, payments for property or services in the current or any of the past three fiscal years that exceed 5% of that organization’s consolidated gross revenues for that year, or $200,000, whichever is greater, other than (i) payments arising solely from investments in that organization’s securities, and (ii) payments under non-discretionary charitable contribution matching programs.

Our Board of Directors will also consider a director’s charitable relationships when assessing director independence.

Under these criteria, our Board of Directors has determined that the following members of our Board of Directors are independent: David R. Bock, Michael B. Clement, Alan L. Hainey, Steven G. Norcutt, and Lisa A. Pendergast. We presently have sixseven directors, including these five independent directors.

To assist in the discharge of its responsibilities, our Board of Directors has established threefour standing committees: (i) the Audit Committee, (ii) the Compensation Committee, and (iii) the Nominating & Corporate Governance Committee and (iv) the Investment Committee. The principal responsibilities of each committee are described below. Actions taken by any committee of our Board of Directors are reported to our Board of Directors, usuallyconcurrent with or at the meeting following such action. Each standing committee has a written charter, a current copy of which is available for review on our website at www.nymtrust.com.

Audit Committee

The Audit Committee of our Board of Directors is comprised of Messrs. Clement (Chairman)(Chair), Bock Hainey and Norcutt.Norcutt . Our Board of Directors has determined that each of the Audit Committee members is independent, as that term is defined under the enhanced independence requirements for audit committee members set forth in the rules of the SEC and in accordance with the Company’s independence criteria discussed under “—Independence of Our Board of Directors,” and that each of the members of the Audit Committee can read and understand fundamental financial statements and as such, is financially literate, as that term is interpreted by our Board of Directors. In addition, our Board of Directors has determined that each of Messrs. Bock, Clement and Norcutt is an “audit committee financial expert” as that term is defined in the SEC rules. For more information regarding the relevant experience of our audit committee financial experts, see each such individual's biography set forth under “Proposal No. 1: Election of Directors—Nominees for Election as Directors.” Mr. BockClement also serves on the board and audit committee of the more than 40multiple funds that comprise the AXA Equitable Holdings, Inc. complex. Our Board of Directors considers the AXA Equitable Holdings, Inc. complex to be one fund for purposes of the Audit Committee's charter. Until his retirement on December 31, 2019, Mr. Bock also served on the board and audit committee of the multiple funds that comprise the Amundi Pioneer Funds complex. Our Board of Directors considersconsidered the Amundi Pioneer Funds complex to be one fund for purposes of the Audit Committee’s charter.

The Audit Committee operates under a written charter adopted by our Board of Directors. The primary purpose and responsibilities of the Audit Committee include, among other things:

•assisting our Board of Directors in fulfilling its oversight responsibility relating to:

| |

| ▪ | the integrity of our financial statements and financial reporting process, our systems of internal accounting and financial controls and other financial information provided by us; |

| |

| ▪ | our compliance with legal and regulatory requirements; and |

| |

| ▪ | the evaluation of risk assessment and risk management policies; |

overseeing the audit and other services of our independent registered public accounting firm, including the selection of the lead audit engagement partner, and being directly responsible for the appointment, replacement, evaluation, independence, qualifications, compensation and oversight of our independent registered public accounting firm, who reports directly to the Audit Committee;

monitoring non-audit services provided by the independent registered public accounting firm and the related fees for such services for purposes of determining the independence of the independent registered public accounting firm;

fostering open communication, including meeting periodically with management, the internal auditor and the independent registered public accounting firm in separate executive sessions to discuss any matters that the Audit Committee or any of these groups believe should be discussed privately;

reviewing and discussing with management and the auditors our quarterly and annual financial statements and report on internal control and the independent registered public accounting firm’s assessment thereof; and

reviewing and approving related party and conflict of interest transactions and preparing the audit committee report for inclusion in our annual proxy statements for our annual stockholder meetings.

The Audit Committee met 1511 times during the year ended December 31, 20172019 and met four times in executive session with our independent registered public accounting firm. For more information, please see “Audit Committee Report” herein.

Compensation Committee

The Compensation Committee of our Board of Directors is comprised of Ms. Pendergast (Chair) and Messrs. Norcutt (Chairman), Bock Clement and Hainey.Clement. Our Board of Directors has determined that each of the Compensation Committee members is independent in accordance with the Company’s independence criteria discussed under “—Independence of Our Board of Directors” and the independence standards of the Nasdaq that apply to Compensation Committee members. The Compensation Committee operates under a written charter adopted by our Board of Directors. In addition, the Compensation Committee administers our incentive compensation plans and equity-based compensation plans and programs. The Compensation Committee’s basic responsibility is to ensure that our Chief Executive Officer and other key members of management are compensated fairly and effectively in a manner consistent with the Company’s stated compensation strategy, competitive practice, applicable regulatory requirements and performance results.

The Compensation Committee met nineten times during the year ended December 31, 2017.2019.

Investment Committee

The Investment Committee of our Board of Directors is comprised of Messrs. Norcutt (Chair) and Hainey and Ms. Pendergast. Our Board of Directors has determined that each of the Investment Committee members is independent in accordance with the independence criteria discussed under “—Independence of Our Board of Directors.” The Investment Committee operates under a written charter adopted by our Board of Directors. Among other duties, this committee:

reviews the Company’s investment guidelines to ensure that they are appropriate for the Company at least every year, or more frequently if determined necessary by the Investment Committee in its discretion, and present to our Board of Directors for its approval any changes the Investment Committee deems appropriate.

oversees the Company’s investments, ensuring compliance with the Company’s investment guidelines, including approval of investment transactions in accordance with these guidelines; and

reviews and recommends to our Board of Directors our overall investment policy and strategy.

The Investment Committee was first established by our Board of Directors on June 28, 2019. The Investment Committee met two times during the year ended December 31, 2019.

Nominating & Corporate Governance Committee

The Nominating & Corporate Governance Committee of our Board of Directors is comprised of Messrs. Bock (Chair) and Hainey (Chairman), Bock, Clement and Norcutt.Ms. Pendergast. Our Board of Directors has determined that each of the Nominating & Corporate Governance Committee members is independent in accordance with the independence criteria discussed under “—Independence of Our Board of Directors.” The Nominating & Corporate Governance Committee operates under a written charter adopted by our Board of Directors. Among other duties, this committee:

identifies, selects, evaluates and recommends to our Board of Directors candidates for service on our Board;Board of Directors;

oversees the evaluation of our Board of Directors and management; and

oversees compliance with our stock ownership guidelines for non-employee directors and our Chief Executive Officer.officers.

The Nominating & Corporate Governance Committee met foursix times during the year ended December 31, 2017.2019.

Other Committees

From time to time, our Board of Directors may establish other committees as circumstances warrant. Those committees will have the authority and responsibility as delegated to them by our Board of Directors.

Executive Sessions of Our Independent Directors

The independent directors of our Board of Directors will occasionally meet in executive session that excludes members of the management team. During 2017,2019, the independent directors of our Board of Directors met in executive session fivefour times. Our Board of Directors has established a process by which the Lead Director will preside over meetings of our independent directors. Pursuant to this process, the Lead Director has the power to lead the meetings of our independent directors, set the agenda and determine the information to be provided. However, in practice, these meetings tend to be less formal procedurally and, generally allow for each participant to raise such matters and discuss such business as that independent director deems necessary or desires. Stockholders and other interested persons may contact the Lead Director, who is independent, in writing by mail c/o New York Mortgage Trust, Inc., 275 Madison90 Park Avenue, New York, New York 10016, Attention: Secretary. All such letters will be forwarded to the Lead Director. For more information on how to communicate with our other directors, see “—Communications with Our Board of Directors.”

Board of Directors Leadership Structure

Pursuant to our Corporate Governance Guidelines, our Board of Directors has not established a fixed policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board of Directors. Instead, the Board of Directors believes this determination is part of the succession planning process and should be considered upon the appointment or re-appointment of a chief executive officer.

Our Board of Directors is currently led by its Chairman, Steven R. Mumma, who also serves as our Chief Executive Officer. Mr. Mumma was appointed as the Chairman of our Board of Directors, effective March 30, 2015. In connection with Mr. Mumma’s appointment as Chairman, our Board of Directors has adopted a policy that provides that in the event our Chairman is also an executive officer of the Company, our independent directors will select a Lead Director from among themselves. Mr. Alan Hainey, an independent director of the Company since 2004, serves as our Lead Director, a role he was initially appointed to on March 30, 2015. Our Lead Director's role exists, according to our Board of Director’s policy, (i) to provide leadership to our Board of Directors when the joint roles of Chairman and Chief Executive Officer could potentially be in conflict; (ii) to ensure that our Board of Directors operates independently of management; and (iii) to provide our directors with an independent leadership contact.

Our Lead Director's responsibilities, as set forth in our Board of Directors’ policy, include:

chairing an executive session during each Board of Directors meeting without management (including without our Chairman and Chief Executive Officer) present in order to give independent directors an opportunity to fully and frankly discuss issues, and to provide feedback and counsel to our Chairman and Chief Executive Officer concerning the issues considered;

reviewing and discussing with our Chairman and Chief Executive Officer the matters to be included in the agenda for meetings of our Board of Directors;

acting as liaison between our Board of Directors and the Chief Executive Officer;

establishing, in consultation with our Chairman and Chief Executive Officer, and with the Nominating & Corporate Governance Committee, procedures to govern and evaluate our Board of Directors’ work, to ensure, on behalf of stockholders, that our Board of Directors is (i) appropriately approving our corporate strategy and (ii) supervising management's progress against achieving that strategy; and

ensuring the appropriate flow of information to our Board of Directors and reviewing the adequacy and timing of documentary materials in support of management's proposals.

Our Board of Directors has vested the offices of Chairman and Chief Executive Officer in Mr. Mumma because it believes that combining the roles of Chairman and Chief Executive Officer facilitates the flow of information between management and our Board of Directors, while providing the appropriate balance between independent oversight of management and efficiency of the operation of our Board of Directors. Furthermore, our Board of Directors believes that having our Board of Directors’ deliberation of strategic alternatives framed by the person who (i) is the most knowledgeable about the Company and its industry, (ii) has been most instrumental in transforming the Company from a vertically integrated residential mortgage origination and portfolio investment manager into a diversified investment portfolio manager, and (iii) is responsible for executing our strategy is the optimal means for our Board of Directors to discharge its responsibility of establishing strategy. For these reasons, we believe our Board of Directors leadership structure is appropriate for the Company and does not affect our Board of Directors’ approach to risk oversight.

Our Board’sBoard of Directors’ Role in Risk Oversight

We face a variety of risks, including interest rate risk, credit risk, and liquidity risk, many of which are discussed under “Item 1A. Risk Factors,” “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Item 7A. Quantitative and Qualitative Disclosures About Market Risk,” each included in our Annual Report on Form 10-K for the year ended December 31, 2017.2019. Our Board of Directors has oversight responsibility with regard to assessment of the major risks inherent in our business and the measures we use to address and mitigate such risks, while our Chairman and Chief Executive Officer and other members of our senior management team having responsibility for continually assessing and managing those risks. In performing its oversight role, our Board of Directors believes that an overall review of risk is inherent in its consideration of our long-term strategies and in the transactions and other matters presented to it and that an effective risk management system will (1) timely identify the material risks that we face, (2) communicate necessary information with respect to material risks to our Chairman and Chief Executive Officer or other officers of the Company and, as appropriate, to our Board of Directors or relevant committee thereof, (3) implement appropriate and responsive risk management strategies consistent with our risk profile, and (4) integrate risk management into management and our Board of Director’sDirectors’ decision-making.